We are very excited that a growing number of financial institutions are eager to build a diversified portfolio of shares in Super Locations. Relying on the rating by Ryder Scott and the protection of the governance created by Baker Botts in the SLU ecosystem, investors can get a direct exposure to a high yield new asset class without having to open datarooms.

Even before the Live Marketplace opens in Q2-2023, investors are accumulating positions in Super Location, prior to the inscription of the shares on the market (Pre-IPO investment).

Although our team is actively working at the delineation of Super Locations with 8 Permian E&Ps, we are very keen to list more properties on the Market and as we have more buyers than sellers, we would welcome discussions with other E&Ps eager to discover SLU Enterprise. Listing a Super Location does not necessarily mean selling any Working Interests. It can be a Price Discovery mechanism with only a few shares in Super Locations proposed for transactions.

ESG aligned Super Locations are especially attractive for Institutional Investors. It is indeed difficult to find investment opportunities with a decent IRR while having a real and immediate impact on the climate. ESG Super Locations brings a great reporting, a transparent measure of venting and flaring and price discovery together.

At the SLU Enterprise, 3yrs ago we set out to establish a new asset class of “oil in the rock” to better value undeveloped acreage and deliver an investment option for climate impact investors that want to make money AND make a meaningful difference in the fight to reduce emissions.

Q2-2023, this will become a reality! With steadily growing support and enthusiasm from the investment community and E&P’s – understanding of how we package the asset and development plan into a Ryder Scott rated security with a governance structure (standards, LLC, JOA) written by Baker Botts is at an all-time high, and we have many assets in preparation and planning phase to be listed (think Asset IPO!).

ESG Super Locations, are designed specifically for the generalist, climate conscious investor, by cutting emissions and proving it! From the facility design, to the measurement system to reporting process, the impact is measurable and transparent. For operators, this process sets up a unique price discovery mechanism for both long dated or stranded inventory AND their ESG efforts, by offering shares of the listed assets on the trading platform to expose live market pricing for these structured securities. And with a limited set of opportunities to get attractive IRRs and support clean energy – the educating discussions we have with leaders in these investment groups are very exciting. Our team is working with E&P’s all day every day to prepare these assets for the market launch (setting the stage for a few “Pre-IPO” investment opportunities. Reach out to discuss your assets, or to find out how to explore investment opportunities.

All the Best!

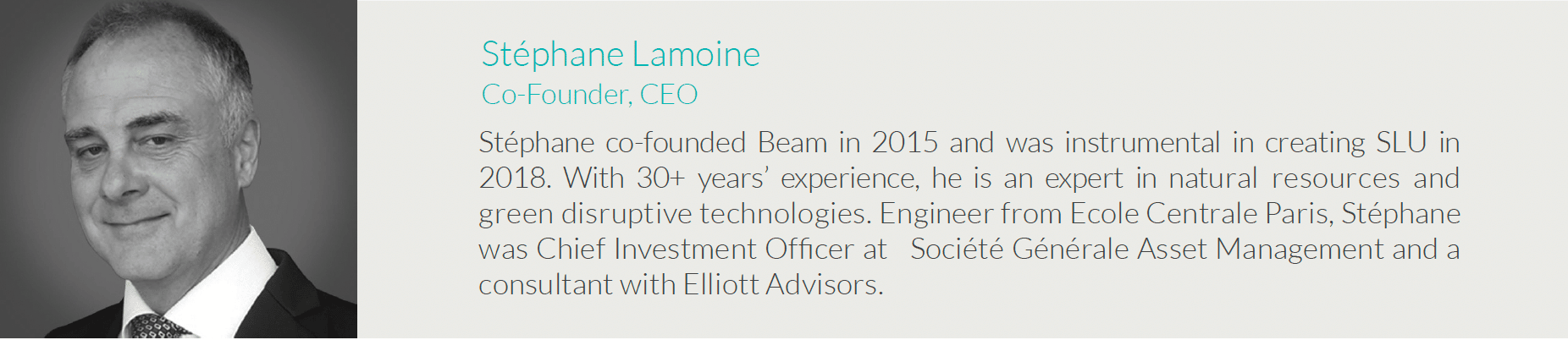

Stéphane Lamoine